new mexico solar tax credit 2020 form

Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes. The federal solar tax credit.

Community Solar Near Me Sign Up Save 10 On Electricity

Click New Solar Market Development Continue Enter up to three credit certificates and the amount of credit applied to tax.

. SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the fiduciary income tax return Form FID-1. Your state tax credit would be equal. See form PIT-RC Rebate and Credit Schedule.

For assistance see the New Solar Market Development Income Tax rule 3314 NMAC for personal income taxes or 3421 NMAC for corporate income taxes and other information available at the Clean Energy. Check 2022 Top Rated Solar Incentives in New Mexico. The bill states that a business or homeowner who purchases and installs a solar energy system on or after March 1 2020 are eligible for this non-refundable tax credit.

Home 2020 mexico new tax. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit. The credit is capped at 6000.

It covers 10 of your installation costs up to a maximum of 6000. New Mexicos popular solar tax credit scheme that previously aided about 7000 residents is brought into action again. Check Rebates Incentives.

The tax credit is up to 10 of the purchase and installation of the solar panels. The new solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2020 and has purchased and installed a qualified photovoltaic. The wait is over.

A taxpayer claimant that holds an advanced energy tax credit certified by the New Mexico Environment Department NMED and approved by the New Mexico Taxation and Revenue Department TRD may use Form RPD-41334 Advanced Energy Tax Credit Claim Form to claim the tax credit against personal or corporate income due or gross receipts tax compensating. This tax credit is based upon ten percent of the solar system value and is available for solar thermal and photovol taic solar systems. 12790 Approximate system cost in NM after the 26 ITC in 2021.

Youll find this credit in Business Credits within the New Mexico portion of TurboTax. Since most average sized 6kW systems cost about 18000 you can expect a credit of about 1800. The solar market development tax credit may be deducted only from the taxpayers New Mexico personal or fiduciary income tax liability.

Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. Lets say you install an 18000 solar panel system on your home. New Mexico Solar Tax Credit 2020 Form.

The residential ITC drops to 22 in 2023 and ends in 2024. 375 enacted in april 2009 created a tax credit in new mexico for geothermal heat pumps purchased and installed between january 1 2010 and december 31 2020 on property owned by the taxpayerThe new mexico solar tax credit is senate bill 29. Why Should You Go Solar.

Enter Your Zip See If You Qualify. 100s of Top Rated Local Professionals Waiting to Help You Today. The maximum tax credit per taxpayer per year.

Even before the return of the state tax credit switching to solar in New Mexico would bring you substantial savings on your electric bill. New mexico solar tax credit 2020 form Monday February 21 2022 Edit. First come first served - the solar tax credit has an annual allotment of.

The solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006 and has purchased and installed a qualified photovoltaic or a solar thermal system after January 1 2006 but before December 31 2016 in a residence business. Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package. The New Mexico State Legislature passed Senate Bill 29 in early 2020.

Form and Submittal Instructions. As of 112020 the first year of the tax reduction started with a 4 drop from the initial 30 credit to 26. The New Solar Market Development Income Tax Credit was passed by the 2020 New Mexico Legislature.

New Mexico state solar tax credit. The starting date for this tax credit is March 1 2020 and the tax credit runs through December 31 2027. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits.

It provides a 10 tax credit with a value up. The balance of any refundable credits after paying all taxes due is refunded to you. The credit is applicable for up to 8 years starting in 2020.

But the new solar tax credit really pushes your savings over the top making solar an even better investment than it was in the past. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. Obviously there are many incentives to go solar such as the benefits provided by the New Mexico solar tax credit but truly solar can be viewed as an.

The Solar Market Development Tax Credit provides a tax credit of 10 for small solar systems including on-grid and off-grid PV systems and solar thermal systems. Ad Enter Your Zip Code - Get Qualified Instantly. Note that the residential part of the Solar Tax Credit will be completely eliminated from 2022 onward while a 10 tax credit will remain for only industrial commercial and utility-scale projects.

Husband And Wife Age 40 And 38 Living In Bronte Ontario The Husband Is A Tax Lawyer At A Law Firm In Toronto The Family Cartoon Cartoon Images Babysitter. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. This area of the site summarizes New Mexicos business-related tax credits and the procedures for claiming them.

New Mexico state tax credit. 7 Average-sized 5-kilowatt kW system cost in New Mexico. The tax credit applies to residential commercial and agricultural installations.

This bill re -started the popular residential solar tax credit program. This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems. This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower.

General types of tax credits are. After it expired in 2016 New Mexicos governor Michelle Lujan Grisham signed the New Solar Market Development Tax.

Taxact 2020 State 1040 Edition State Federal Tax Filing

Certified Bonds Climate Bonds Initiative

Texas Solar Incentives Tax Credits Rebates Sunrun

Fact Vs Myth Can Solar Energy Really Power An Entire House 2021 Update Bluesel Home Solar

Community Solar Near Me Sign Up Save 10 On Electricity

Community Solar Near Me Sign Up Save 10 On Electricity

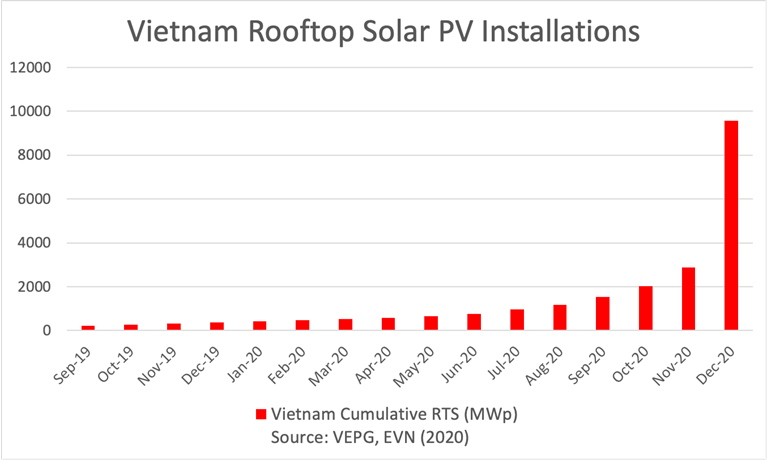

Vietnam Rooftop Solar Records Major Boom As More Than 9gw Installed In 2020 Pv Tech

Full Guide To Residential Solar Panels In Texas Updated For 2021

Vietnam Rooftop Solar Records Major Boom As More Than 9gw Installed In 2020 Pv Tech

What Solar Incentives Do I Qualify For Solar Tribune

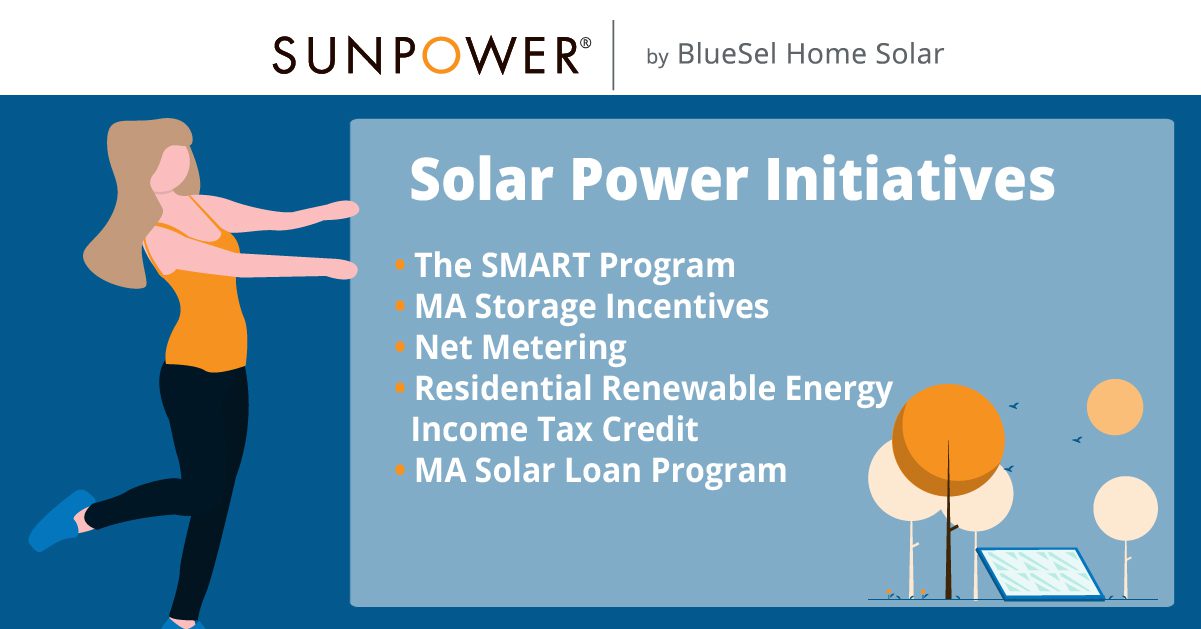

2022 Massachusetts Solar Incentives Tax Credits

Fact Vs Myth Can Solar Energy Really Power An Entire House 2021 Update Bluesel Home Solar

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Towards A Roadmap For Armenia S Buildings Energy Efficient Buildings In Armenia A Roadmap Analysis Iea

New Mexico House Committee Tables Bill Aimed To Boosting Hydrogen Production Albuquerque Business First

Power Struggle Santa Fe Reporter